Over the past few years, the use of Robotic Process Automation (RPA) in the financial sector has grown exponentially for efficiency-boosting and cost-saving. However, the promised benefits have not yet materialized because RPAs only automate stand-alone tasks. Therefore, an integrated system that enables an end-to-end focus is needed to ensure that not only separate tasks are well-performed, but also the entire process is efficient. Earlier this year, Gartner suggested hyperautomation is the next step that businesses need to take to accelerate their digital transformation.1 Hyperautomation refers to the mixture of automation technologies that exist to augment and expand human capabilities. It is about using advanced technologies, such as Artificial Intelligence (AI), Machine Learning (ML), and RPA to fully automate tasks once completed by humans. In this blog, you will learn about the challenges that the financial sector is facing and how hyperautomation can be the solution.

Read more about the key aspects of hyperautomation here.

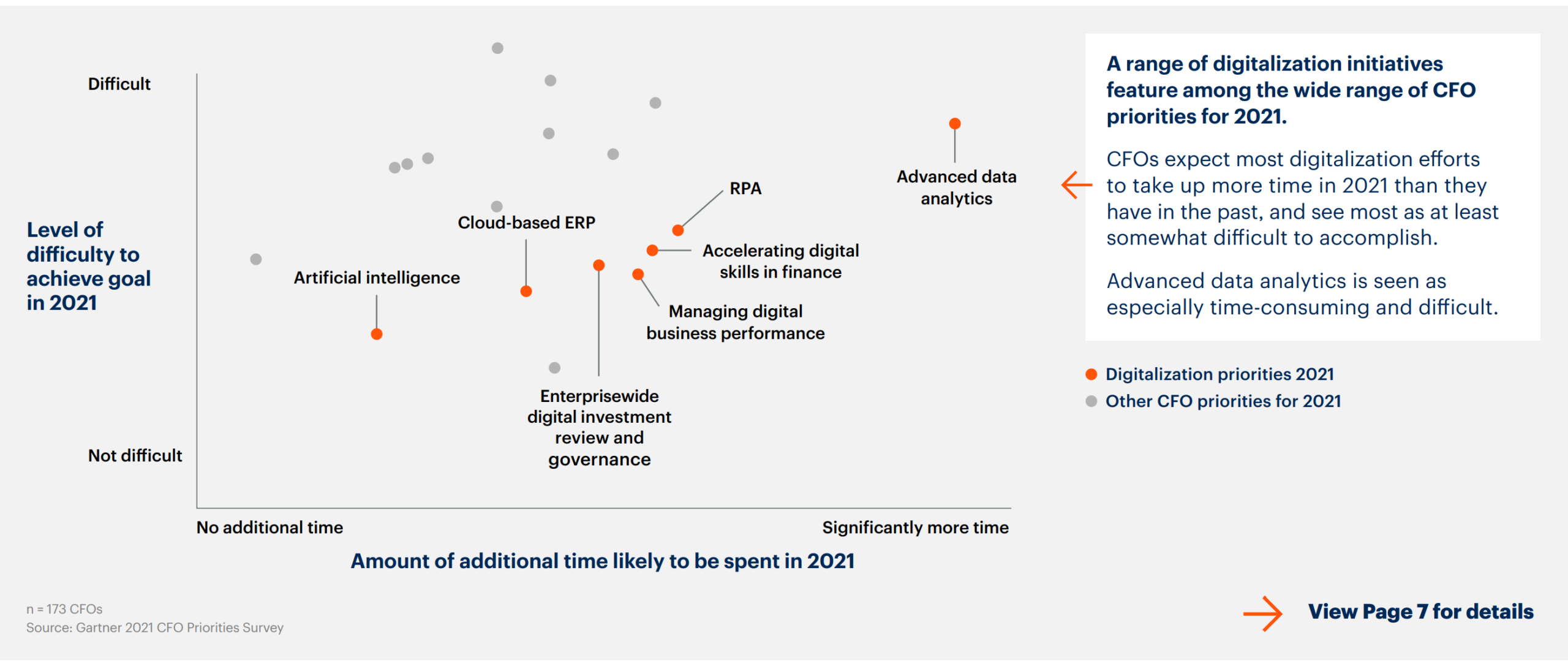

2021 digitalization priorities

The pandemic came and brought many changes with it. Among those changes, there are difficulties, but opportunities also lie within. According to KPMG, 59% of business executives say the pandemic has created an impetus to accelerate their digital transformation initiatives.2 Not only did the pandemic unveil many new challenges, but it also was a wake-up call for executives to rethink and redesign their business strategies. To reach their organizations’ goals, CFOs feel the pressure to realize these ambitions. However, digitalization is no easy task. A Gartner’s study investigating CFOs’ digitalization priorities for 2021 found that mastering technologies such as artificial intelligence (AI), Cloud-based ERP, and RPA are expected to take a significant amount of time.3

Juggling with digitalization priorities and industrial challenges

To stay competitive, businesses must accelerate their digital transformation. This requires a lot of effort and can be very time-consuming. Therefore, it is critical that executives determine how to balance digitalization priorities and existing industrial challenges.

Keeping the regulations in check

Constant changes in regulation cost many businesses in the financial sector a great sum of money. For instance, in 2018, a Dutch bank paid a fine of $900 million for failing to spot money laundering.4 According to Martijn Steffers, Director of Sales and Marketing at Be Informed, some companies nowadays are still using Excel to keep track of legislation that is renewed every 12 minutes. The lack of automation is not only costly and time-consuming but is also error-prone.

Delivering great customer experience

Amid the pandemic, financial institutions still need to support customers through their growing financial stress. Social distancing and working from home make this hard. This has opened up a new horizon in digital adoption among customers. Digitalization, therefore, became a bridge that helps institutions deliver quality services to their customers. Besides the effect of the pandemic, a study in 2019 from Accenture suggested that 1 in 2 customers want personalized advice from banks based on their circumstances.5 Steffers strongly believes this as well: “Consumers today want personalization and recognition. They do not wish to spend time on customer journeys or mundane processes. To stay relevant, companies must keep up with these demands.”

Keeping up with new technology

RPAs and other workflow automation tools are popular. However, they do not easily scale across the organization. CFOs, therefore, expect that digitalization efforts require a lot of time and human skills.

Digital skills are needed to accelerate businesses’ transformation. New automation tools, new processes come with formal training and practice. In fact, 72% of finance hiring managers expect an increasing digital competency gap in the next 3 years which exacerbates inability to take advantage of digital investment.6 Therefore, not only some digital development goals are challenging to achieve, but employee engagement, retention, and skilling are also expected to take time and effort.

Taking the next step to hyperautomation with Be Informed

In the previous section, we discussed digitalization priorities and industrial challenges the financial sector is facing. It is evident that having a long-term solution that involves a combination of technologies, people, and processes is important.

What the financial sector needs…

- A system that helps identify new regulations, integrate data structure, and connect regulations to operational processes.

- A platform that utilizes user data, manages personalized offers and services for a great customer experience.

- One centralized platform that manages, automates and orchestrates cross-organizational processes that is easy to update and manage.

Be Informed provides a hyperautomation solution

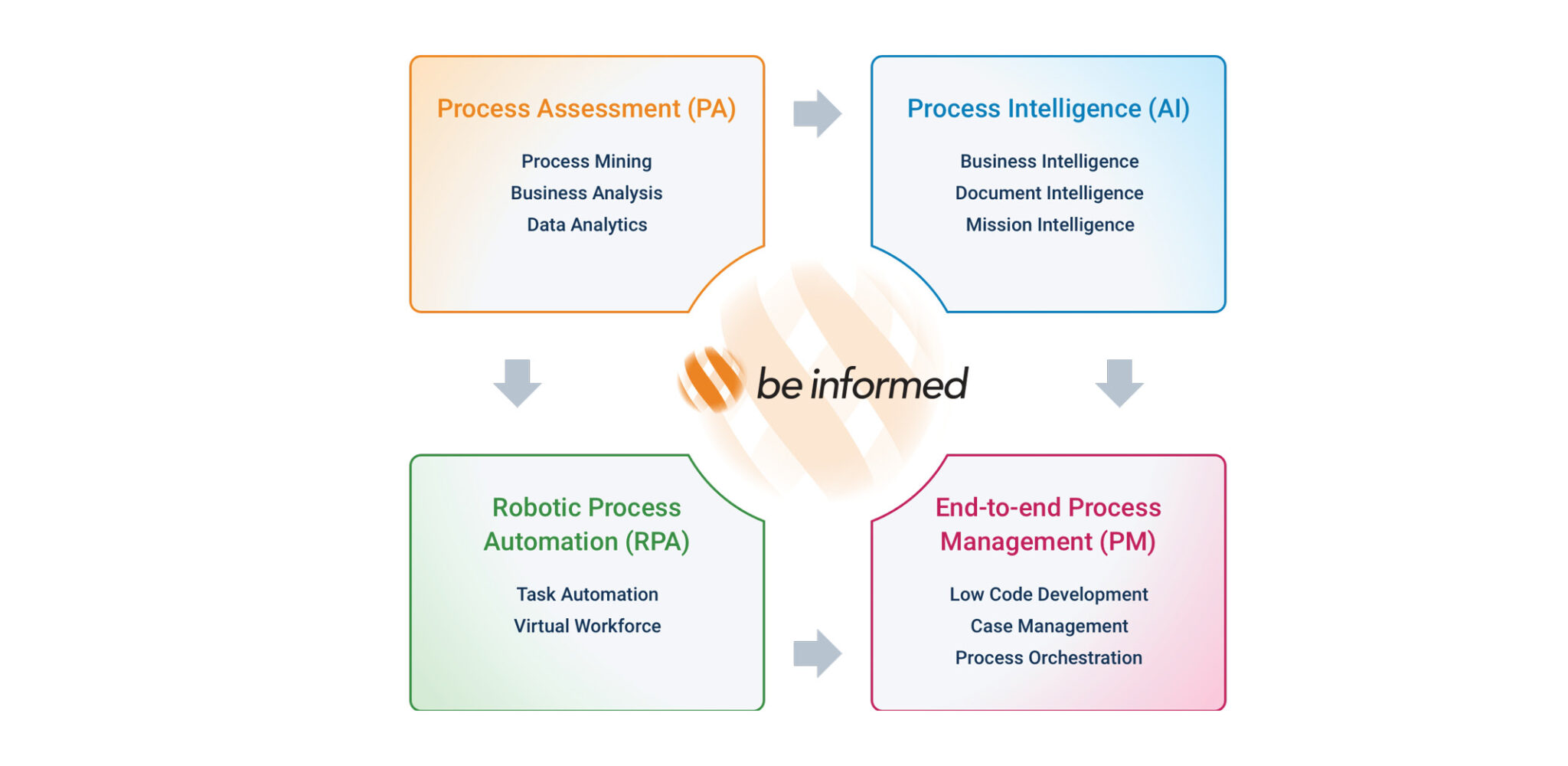

Our team of experts developed a hyperautomation solution to augment task-based RPA and AI/ML implementations: the Robo Orchestrator. The solution manages, automates, and orchestrates end-to-end business processes. It combines the Be Informed intelligent model-driven automation and orchestration platform with Process Assessment, Process Intelligence, Robotic Process Automation, and End-to-End Process Management. The Robo Orchestrator can be the key to overcoming the existing limitations in the financial sector.

Need consultation? Get in touch with our expert today!

Martijn Steffers

Director of Sales and Marketing

m.steffers@beinformed.com

T +31 (0)55 3681420

M +31( 0)6 18755692

[1] Gartner: Predicts 2021: Accelerate Results Beyond RPA to Hyperautomation

[2] https://advisory.kpmg.us/articles/2020/enterprise-reboot.html

[3] https://emtemp.gcom.cloud/ngw/globalassets/en/finance/documents/trends/finance-top-priorities-2021.pdf

[4] https://www.reuters.com/article/us-ing-groep-settlement-money-laundering-idUSKCN1LK0PE

[5] https://www.accenture.com/_acnmedia/pdf-95/accenture-2019-global-financial-services-consumer-study.pdf

[6] http://public2.brighttalk.com/resource/core/320313/jan28cwiltonnqueallyschampanericchristensen_706795.pdf