Customer challenges in the financial sector

Nowadays customers can reach out through all sorts of communication channels: the website, portals, apps and other online tools. Mobile devices offer highly accessible tools to handle financial transactions anytime, anywhere. This has great potential, as it gives customers the opportunity to arrange their financial transactions and services independently. With this, customer expectations rise. They count on financial organizations to be available, always, just like their favorite apps. To live up to these expectations, financial organizations will have to digitally develop. Besides that, customers demand more personalized services. Standard customer journeys are no longer sufficient. The data that has been collected throughout the years can be utilized to offer them such a personal service. However, there are still many organizations whose digital transformation is lagging. In that case, a customer request often ends up with a human employee while it can easily be automated. What is going on here? Some examples:

- There is no connection between underlying systems, so data cannot be exchanged, making it very difficult to provide personal customer services.

- The bots used (i.e. chatbot or voice bot) are not capable enough. These bots are great at the task they need to fulfill, but because of the lack of intelligence, do not contribute to the overall process.

- The used technology cannot be altered easily. This makes it hard to keep up with changes in regulations or customer needs, let alone anticipate on them.

Working towards Agile financial services

When you take a closer look at the above challenges combined with the ever-changing customer needs, working in an Agile way plays a key role in solving them.

However, even when the Agile rules are thoroughly followed, another challenge might be lurking before you achieve Agile financial services. The IT architecture may turn out to be a big barrier to truly work Agile. Systems might be inflexible, closed off to pair and unable to communicate with other systems. They stand alone. As a result, implementing a new feature because of changed regulations or to achieve better customer engagement, requires a complex integration and iterative testing to make sure it doesn’t crash other features. In some cases, the system may have been acquired as a standard solution, and it is difficult to convince the software supplier to make the change and release it within a short period of time. Generally, such requests are not part of the Service Level Agreement. The Agile organization needs open systems, that can communicate through API’s and are flexible enough to handle changes in customer behavior, technology, competition, laws and regulations. How to go from here?

Shift from standalone systems to Agile solutions

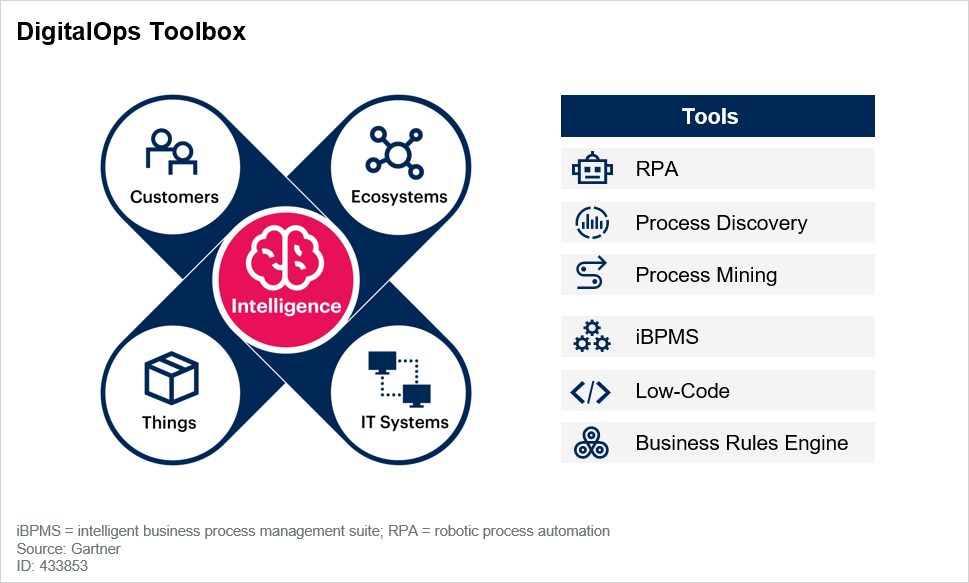

Let’s dive deeper into the fundament of collaboration. In order to become Agile and offer such financial services, multiple people from different departments must cooperate to achieve this mutual goal. Especially the business and IT must work perpetually together to deliver new products and features. This demands a transformation; not just one involving people and processes, but also with much attention for the used systems. These systems are the baseline for making effective, efficient and Agile processes possible. The highly necessary shift involves evolving from standalone systems to solutions communicating with each other, offering adaptability and therefore facilitating Agility. Gartner, a major IT advisory firm, suggests that all necessary systems should be connected using a digital toolbox to achieve ‘hyper automation’. These systems have requirements though, such as low coding, orchestration and case management. When all conditions are met, the digital toolbox clears the road to truly work Agile. Be Informed can be positioned as an essential tool in this digital toolbox.

Source: Gartner 2020 – DigitalOps Toolbox

Establish ground to service customers better

It is not likely a financial organization can simply replace all legacy systems with brand new and agile solutions, due to the challenges and costs that come with complete replacement. However, financial organizations do need to employ modern IT architectures. An alternative to purchasing new systems may be to consider a low-code intelligent automation platform. Such a platform can be implemented as a functional layer on top of the original standalone systems, enabling data transfer and making changes possible whenever this is needed. In addition, it is capable of converting manual work to automated work. That does sound Agile, doesn’t it? Combine this intelligent automation platform with DevOps practices to automate the release of new features, and to integrate several IT systems to create more conformity. By approaching systems in an Agile manner, you’ll establish ground to service customers better with financial services, be more competitive and grow faster.

What is up next?

Today we discussed the value of Agile systems and our solution enabler for the financial sector. Next time we will zoom in on customer personalization. How do you know, recognize and acknowledge customers in the financial sector? Stay tuned by signing up below or follow us on LinkedIn, Twitter and Facebook to stay in the loop always.