Automated compliance for the financial sector

Built for compliance teams, risk managers, and legal experts in financial organizations who need clarity, speed, and oversight.

Smarter compliance for a world of changing rules

Automated financial compliance that adapts to evolving regulations, supports real-time monitoring, and delivers full traceability across policies and reporting.

Compliant without the chaos

Financial institutions operate in complex, fast-moving regulatory environments. New obligations emerge every 12 minutes, from privacy regulations to sanctions. Staying compliant means constant updates to policies, systems, and internal controls, often with high manual effort and outdated tools.

We are here to help you reduce the burden by:

- Automate the compliance process

- Keeping your governance frameworks aligned as rules change

- Faster introduction of services without regulatory delays

- Minimize compliance risk and build trust with regulators, customers, and the wider financial system.

Why compliance leaders choose us

Fewer compliance breakdowns mean smoother customer experiences, stronger investor confidence, and a more resilient financial ecosystem.

End the manual madness

Automate the most time-consuming compliance tasks. From interpreting laws to linking them to controls, and cutting down on human error and manual tasks.

Stay on top of regulatory updates

Quickly assess regulatory impact

Understand how each change affects internal policies, controls, and operational processes, way before it causes friction or risk.

Prove compliance instantly

Whether for internal audit procedures, regulatory authorities, or board reporting, your audit process is always up-to-date and documented.

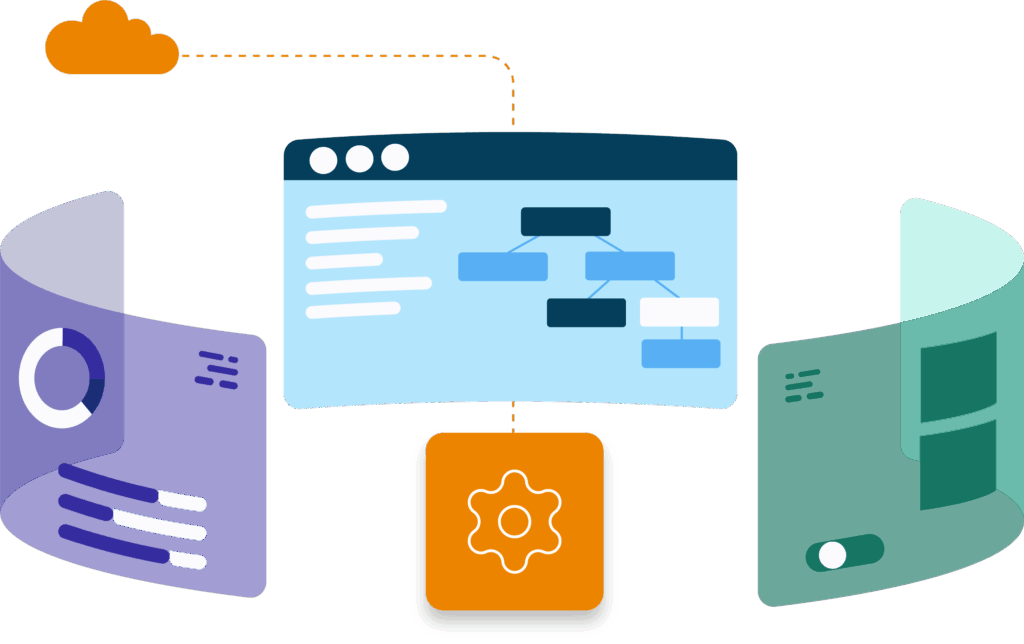

Works with your compliance setup

Key features

Centralized regulation-to-control mapping

Connect every regulatory obligation to your internal policies, controls, and processes, all in one structured model.

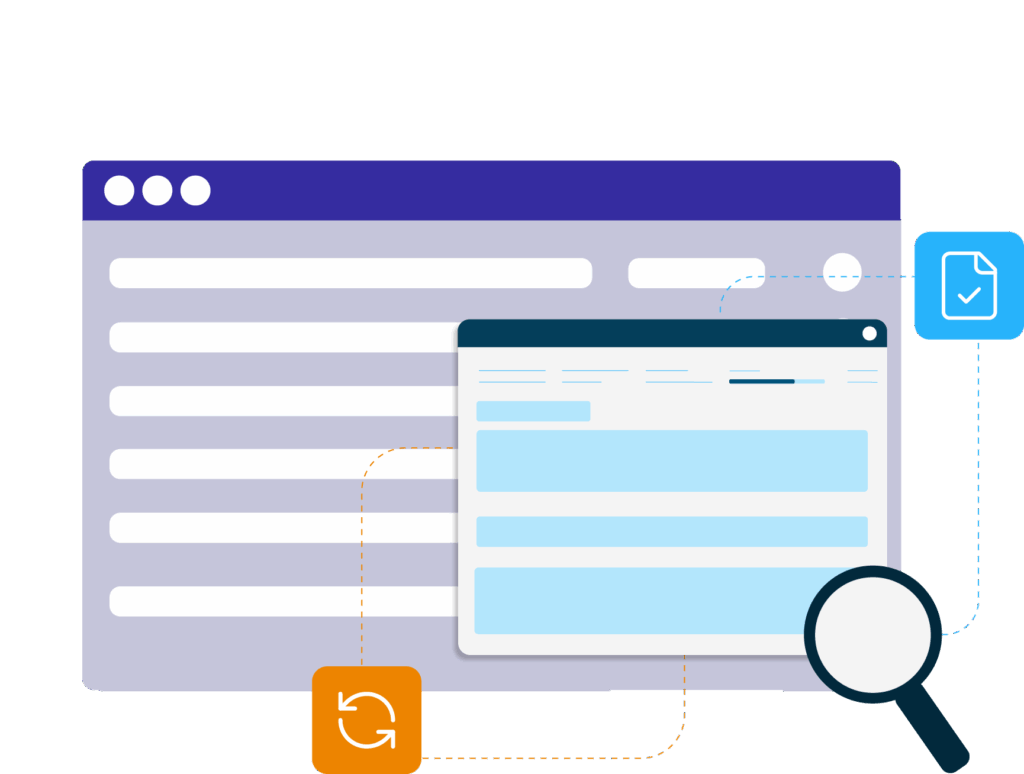

Real-time regulatory change detection

Assign tasks, manage timelines, and resolve conflicting interpretations with full transparency. From the first draft to the approved regulation, it keeps the team aligned.

No-code modeling for legal & compliance teams

Update rules and logic without developer involvement. Make changes visible, explainable, and auditable.

End-to-end traceability

Every obligation, control, and decision is tracked with who, what, when, and why — ready for audit or internal review.

Is Be Informed really built for financial compliance?

Yes. Our RegTech platform supports highly regulated institutions dealing with cross-border complexity, large regulatory volumes, and the need for precision.

A leading Dutch bank cut compliance workload by 60%

Be Informed helped to automate the mapping of regulations to internal controls, enabling faster change implementation and stronger audit readiness. Within months, they eliminated redundant controls and reduced manual workload by 60%.

Bring your regulation into the 21st century