On the surface, HS codes and HTS codes might seem like technical details buried in shipping paperwork. However, they are critical. Classifying your goods correctly impacts duties, compliance risk, pricing strategy, and your ability to move goods smoothly across borders. Get it wrong? You could face fines, audits, shipment delays, or even worse consequences.

HS codes are the bedrock of global standardization, created to facilitate international trade by classifying goods in a universally recognized language. On the other hand, HTS codes provide country-specific adaptations that refine the categorization and taxation of goods when they cross borders. These subtle yet profound differences can significantly impact tariff rates and compliance requirements, directly affecting the profitability and efficiency of trade strategies.

In this article, we’ll walk through what HS and HTS codes are, how they differ, and why correct classification matters more than ever. Whether you’re scaling your trade operations or just starting to navigate customs, understanding these codes is key to staying compliant and competitive.

Key differences between HS and HTS codes

Understanding the differences between HS and HTS codes is crucial for businesses involved in international trade. While both codes are used for classifying goods that are traded across borders, they serve different purposes and operate at varying levels of specificity.

HS code: The global trade identifier

The Harmonized System (HS) code is a six-digit number used by over 200 countries to classify traded goods in a consistent and standardized manner. The World Customs Organization manages it and forms the foundation of international trade classification.

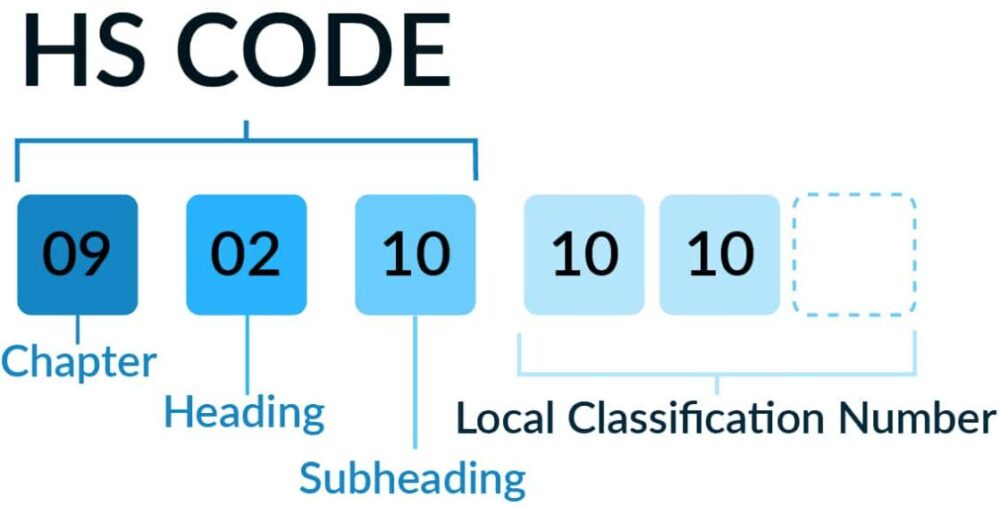

Each code has three parts: the first two digits represent the product chapter (for example, “09” for coffee and tea), the next two define the heading (like “0902” for tea), and the final two specify the subheading (such as “090210” for green tea). Together, they offer a common language for customs authorities, exporters, and importers worldwide.

With more than 5,000 product categories, HS codes support fair trade agreements, enable accurate duty assessments, and make global transactions more transparent and predictable. Countries then build on this foundation by adding their own layers, such as the U.S. HTSUS or the EU’s Combined Nomenclature, to align with national regulations.

HTS code: The local tariff language

While HS codes create a global framework, HTS codes tailor that framework to a specific country’s rules. In the U.S., this system is called the Harmonized Tariff Schedule of the United States (HTSUS). It expands the standard six-digit HS code into eight or ten digits, adding the detail needed for duty rates, quotas, and regulatory controls.

For example, code 0902.10.10.00 refers not only to green tea, but also to green tea in packaging under three kilograms. These added digits determine how a product is treated at the border, including the duties you’ll pay, whether special trade agreements apply, and the required documentation.

The HTSUS is updated regularly to reflect changes in trade policy and global commerce. Staying current is key, especially for businesses looking to reduce costs, qualify for tariff benefits, or avoid compliance issues.

For customs brokers, logistics teams, and compliance professionals, a solid understanding of HTS codes isn’t just helpful. It’s essential to keep shipments moving and strategies on track.

HS Code vs. HTS Code

Aspect | HS Code | HTS Code |

Developed by | World Customs Organization | US International Trade Commission |

Application | Used globally for tariff classification | Specific to the United States, including additional detail |

Structure | 6-digit standard | Up to 10 digits in the HTSUS code |

The role of HS and HTS codes in global trade

As mentioned earlier, HS and HTS codes are essential for more than just paperwork. They shape how goods move across borders. Together, they determine tariff rates, guide customs duties, and help ensure compliance with trade agreements.

Accurate classification is critical during customs clearance. HS and HTS codes provide the common language that customs authorities rely on to process shipments efficiently. When used correctly, they minimize delays, reduce the risk of disputes, and help avoid penalties.

While HS codes offer a globally consistent product classification, HTS codes refine that classification with country-specific detail. This distinction is what customs agencies use to determine the precise duty rates that apply to an imported product.

These codes also influence how businesses benefit from trade agreements. Many tariff reductions hinge on precise HTS classifications. Using the correct code can mean the difference between paying full duty or qualifying for reduced rates under agreements like USMCA or EU FTAs.

To stay compliant and competitive, companies should regularly review classification accuracy and stay updated with changes to tariff schedules.

When classification goes wrong: real-world examples

Misclassification in international trade can have significant consequences for businesses, as illustrated by various case studies.

- Alexis LLC (2024). The women’s apparel firm misreported classification and value from 2015 to 2022. Settled for $7.6 million under the False Claims Act.

- International Vitamins Corporation (2023). Imported supplements misclassified as duty-free over five years. Lack of change after alerts cost them $22.9 million in settlement.

- Samsung C&T America (2023). Misclassified footwear due to inaccurate materials data. Admitted responsibility and settled under FCA.

- Ford Motor Company (2023). Classified cargo vans as passenger vehicles to reduce duties, and ultimately paid $365 million.

When it affects the middleman: The impact on carriers and forwarders

The financial penalties in classification cases often make headlines. However, behind the scenes, air carriers and freight forwarders also face serious consequences.

Delays at customs are one of the most immediate risks. Misclassified goods can trigger inspections or holds, leading to missed connections, storage fees, and frustrated clients. For carriers, every delay incurs additional costs. For forwarders, it erodes reliability.

There’s also the risk of liability. When documentation is submitted on behalf of clients, any errors, especially in the HS or HTS code, can bring legal or financial exposure, particularly if acting as the Importer of Record.

Reputation matters too. Clients expect seamless, compliant service. A pattern of customs issues, even if caused upstream, can reflect poorly on the logistics provider and, in some cases, lead to the loss of preferred status with customs programs such as AEO or CTPAT.

For those managing tight schedules and high volumes, even minor classification errors can create significant friction. Getting it right protects margins, relationships, and long-term competitiveness in a highly regulated space.

Key impacts of misclassification:

- Financial Repercussions: Higher duty rates and unexpected customs duties.

- Delayed Shipments: Prolonged customs clearance is affecting supply chains.

- Legal Implications: Increased scrutiny by customs brokers and trade commissions.

- Trade Statistics Errors: Inaccurate data can influence international trade decisions and agreements.

Ensuring accurate classification under the proper codes is crucial. Leveraging the expertise of the US International Trade Commission guidelines and professional customs brokers can mitigate the risk of costly mistakes and ensure compliance with World Customs Organization standards.

How carriers and forwarders can help get classification right

Air carriers and freight forwarders may not be the ones assigning HS or HTS codes, but they are often the first to spot when something’s off. A proactive approach can reduce risks, build trust with clients, and protect operational flow.

Here’s how:

- Review documentation early. Incomplete or inconsistent product descriptions are often a red flag. Flag issues before the shipment reaches customs.

- Work with clients to clarify unclear classifications. A short delay upfront can prevent a long hold at the border.

- Encourage the use of binding rulings. Advise clients, especially those shipping complex goods, to request official classification decisions from customs authorities to ensure accurate customs clearance. It offers legal certainty and smooths the clearance process.

- Stay informed about updates. HS codes and HTS codes are subject to frequent changes. Partner with clients to keep classification data current.

- Log recurring issues. If certain product categories consistently cause trouble, document them internally and share insights with your team.

Technology can also help. Some forwarders are starting to use smart tools to pre-check classification data before submission. For instance, platforms like International Trade and Transport Compliance Solution (ITTS) include features such as an HS Code Plausibility Checker, which assesses whether a code logically fits a product, and an Explorer Engine that facilitates cross-referencing historical and global standards. These kinds of tools reduce back-and-forth and help identify risky code before it becomes a compliance problem.

The more accurate and consistent the classification upstream, the fewer surprises there will be downstream, for everyone in the supply chain.